Panhandle Legislators Lead West Virginia’s “Bad Idea Machine”

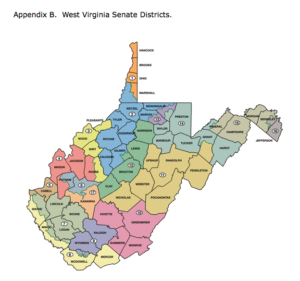

Delegate Mike Pushkin, who represents Charleston’s East End in the House of Delegates, once quipped that the West Virginia Legislature is a “bad idea machine.” Our Eastern Panhandle delegation contains some of the leaders, if that is the proper term, in generating bad ideas. I have recently written that Sen. Patricia Rucker has sponsored a host of bills that advance her far right ideology and religious beliefs. Most notably, these include her sponsorship of Senate Joint Resolution 12 that would put on the November 2018 ballot a proposed amendment to the West Virginia Constitution declaring that nothing in that Constitution creates a right to abortion. Not to be outdone, her Panhandle colleagues in the House of Delegates have introduced pro-gun and anti-public school legislation that give Sen. Rucker a run for her money.

The recent teacher strike has highlighted how badly our government has allowed the state’s public schools to deteriorate. Until the settlement announced on February 27, 2018 is implemented, teacher salaries in West Virginia rank 48th out of 51 state jurisdictions. We are surrounded by states that value their teachers more. And yet the poor-mouthing by Governor Justice about the state’s inability to raise teacher pay was obviously just posturing in light of the 5% bump teachers will now receive.

If there is any truth to the “inability to pay” argument, that inability has been created by a decade of corporate tax cutting that has blown huge holes in the budget. Over this period, West Virginia has relentlessly cut corporate taxes. In the period 2007 to 2014, the Legislature reduced the business franchise tax from .7% to zero and reduced the corporate net income tax rate from 9% to 6.5%.

In the midst of a courageous walkout by teachers in all 55 counties, the Legislature was primed to hand business interests yet another tax cut in the form of eliminating the business inventory tax and may yet do so. Tax cuts for business are nothing more than a choice on how to “spend” revenues, in this case by forgoing revenue that otherwise would be collected and available. Until its hand was forced by the teachers, the Legislature was prepared to spend a big pile of cash on corporations instead of quality education.

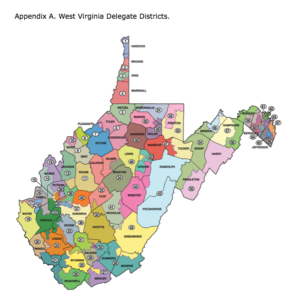

But there is reason to question whether our Panhandle Delegates care about public education at all. Del. Michael Folk (R-Berkeley, 63) has introduced HB 2031, which would eliminate state payment for teacher training or professional development, and HB 2094, which would give home school parents a $100 tax credit per student. This tax credit would begin the process of permitting home school parents not only to opt out of public education but to avoid paying for it like everyone else. This folks is what libertarians want not only when it comes to public education but all government services.

When it comes to guns, our Panhandle Delegates are second to none in the bad idea category. Here Del. Folk fully reveals his extreme views. He sponsored HB 2311, which would declare any federal or local laws or regulations that attempt to tax, regulate or restrict gun ownership void and unenforceable in West Virginia. He clearly needs some re-education about the Supremacy Clause of the U.S. Constitution.

The recent horrible school shootings have perhaps caused us to forget the equally horrible workplace shootings of the near past. Del. Saira Blair (R-Berkeley, 59) may be too young to remember what “going Postal” meant to America but a few short years ago. She has co-sponsored HB 4187, named the Business Liability Protection Act, but referred to as the Parking Lot Gun Act. It would allow an employee, contractor or visitor to a business that bans guns on its property to nonetheless keep a gun locked up securely in their cars while parked in the business parking lot. The business would even be prohibited from inquiring whether a gun is in the car. This bill has now passed the House of Delegates.

In Committee, Del. Riley Moore (R-Jefferson, 67) offered an amendment to HB 4187 that was favored by the NRA to retain the full scope of this bad idea against efforts to soften it. State Chamber of Commerce President Steve Roberts, West Virginia Manufacturers Association President Rebecca McPhail and David Rosier, general manager of administration for Toyota’s Buffalo plant, have all come out against HB 4187, saying it would make their workplaces less safe.

Elections have consequences. The 2016 House of Delegates election produced this crop of Republican legislators and we are now truly living with the consequences. Fortunately, the winds of change are swirling.