Why Excessive CEO Pay Matters to the Rest of Us

Corporate Chief Executive Officers have done very well for themselves during and after the Great Recession. By 2015 the ratio of CEO annual compensation to that of a typical worker had risen to 276 to 1, a much higher ratio than in other developed countries. CEO compensation has gradually taken up a larger and larger share of all corporate revenues. But shouldn’t a corporation be totally free to establish the compensation of its chief executive? Actually, no. The reason is that the rest of us pay for excessive CEO compensation – literally.

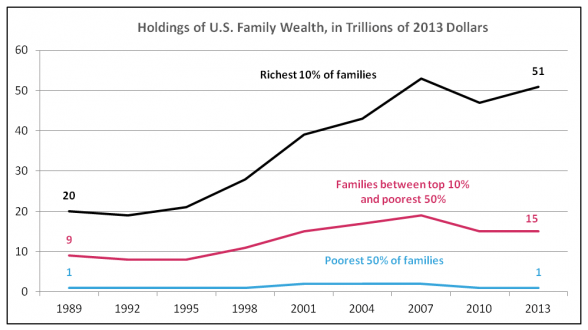

Two recent studies reveal how successful CEOs at the largest U.S. corporations have been in skimming the compensation cream. The first produced by the Economic Policy institute in July 2016 dealt with CEO compensation, defined as salary, bonus, restricted stock grants, options exercised and long-term incentive payouts. It found that between 1978 and 2015, inflation-adjusted CEO compensation rose 940.9% — this was 73% faster than stock market growth for the same period. The typical worker’s annual compensation over the same period grew just 10.3%.

CEOs were spectacularly successful because of their power to direct compensation to themselves within their corporations, not because they were correspondingly more productive, more talented or better educated than other workers. This is demonstrated by the facts that between 1978 and 2015 CEO pay grew faster than corporate profits, the pay of others in the top .1% of wage earners, and the pay of college graduates in general.

U.S. tax law has also contributed to the explosion in CEO pay. A 1993 tax reform law capped the tax deductibility to corporations of executive compensation at $1 million, except that corporations could still deduct any amount of “performance-based” pay from their income taxes. What happened? You guessed it – performance based pay has been heavily adopted. The Joint Congressional Committee on Taxation estimates that closing this loophole would generate more than $50 billion in additional tax revenues over 10 years.

The second important study was produced in December 2016 by the Institute for Policy Studies. It focused on wealth inequality in retirement savings between corporate CEOs and the rest of us. Among the key findings were that the 100 top CEOs have company retirement funds worth $4.7 billion, an amount equal to the entire retirement savings of the 41% of U.S. families with the least retirement savings.

CEOs have amassed such huge retirement accounts because U.S. tax laws favor executives. If you have a 401(k) at work, you have strict limits on how much you can set aside tax-free each year. Workers 50 and older can contribute a maximum of $24,000 each year. But most CEOs of big corporations have no contribution limits because they enjoy special unlimited deferred compensation plans. In 2015 roughly half of Fortune 500 CEOs invested in these plans a total of $227 million more of their pre-tax income than if they had been subject to the same limits that apply to ordinary workers. If they had been subject to the same limits, these CEOs would have owed $90 million more in income taxes last year.

CEOs pay income tax on the money in these special plans only when they withdraw it. At present, the top income tax rate is 39.6%. President-elect Trump has proposed cutting this rate to 33%. If his proposal were enacted, CEOs who withdraw their money from the special retirement plans would avoid $196 million in income taxes.

If we have the political will we can stop this giveaway to already grossly over-compensated members of society.